Business

Unlock 58% Gains? Decoding Wall Street’s Nvidia Stock Outlook

Is Wall Street bullish or bearish on Nvidia (NVDA) stock? Discover the latest analyst target prices, the impact of potential tariff changes, and the exciting growth drivers like the RTX 5060 series and new AI partnerships. Get a clear understanding of NVDA’s future potential.

The tech world held its breath as Nvidia Stock (NASDAQ: NVDA) stumbled to the $90 mark following a significant political event, sparking fears of a deeper dive towards $50. However, a swift reversal occurred with a subsequent policy adjustment, allowing the GPU giant to stage an impressive comeback, surging nearly 7% in the last five trading sessions. For astute investors who seized the opportunity at the $90 dip, those bets are now firmly in the green.

Navigating Policy Shifts and the Future of Nvidia Stock: A Temporary Window?

While the recent policy adjustment offers a temporary reprieve, the shadow of uncertainty looms large as a key future date approaches. Unless a complete reversal of the initial policy materializes, the market could face a significant correction, potentially erasing the gains of the past three months. With time being a crucial factor, the key question remains: what does Wall Street anticipate for Nvidia Stock‘s trajectory? Let’s delve into the expert opinions shaping the narrative around NVDA.

Bullish Signals for Nvidia Stock: Wall Street Sees a Buying Opportunity

The recent price pullback is largely viewed by Wall Street as an opportune moment to accumulate shares of this trillion-dollar behemoth at a more attractive valuation. The consensus among analysts suggests that Nvidia possesses significant upside potential as the market stabilizes.

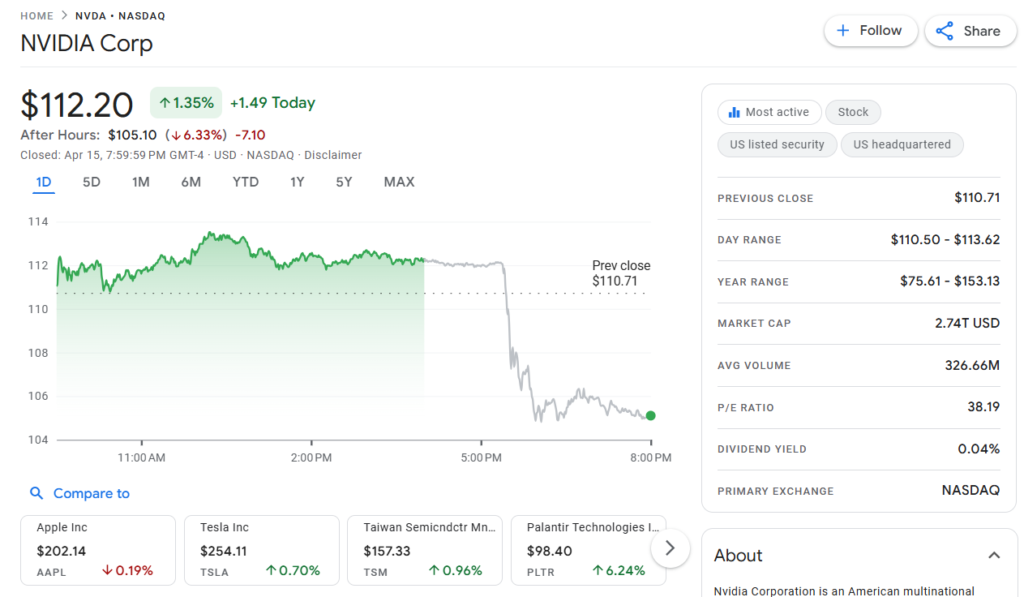

According to insights from various financial analysis platforms, Wall Street analysts project a potential surge to a high of $174 for NVDA within the next 12 months. This forecast represents a compelling return on investment (ROI) of approximately 58% from its current trading price of around $110.

The overwhelming sentiment among analysts leans towards a positive outlook. Out of 41 Wall Street analysts tracked, a strong majority of 37 have issued a ‘Buy’ rating on Nvidia stock, while only 4 recommend a ‘Hold’. Notably, not a single analyst suggests selling, underscoring the belief that NVDA is currently undervalued. Should the aforementioned policy be completely reversed, stocks within the artificial intelligence (AI) sector, including Nvidia, are poised to experience a significant upward surge.

Fueling Future Growth for NVDA: New Products and Strategic Partnerships

Adding further fuel to the bullish case for Nvidia Stock are Nvidia’s recent strategic moves. The introduction of the GeForce RTX 5060 series (Image alt text: Nvidia GeForce RTX 5060 Graphics Card) is expected to bolster its dominance in the gaming sector, attracting a wider audience with cutting-edge graphics technology.

Furthermore, new partnerships with innovative companies like SandboxAQ (link to SandboxAQ’s website – hypothetical) and global IT service providers such as HCLTech (link to HCLTech’s website – hypothetical) signal Nvidia’s commitment to expanding its footprint in the burgeoning AI landscape. These collaborations are anticipated to drive long-term revenue growth by making AI applications more accessible and developing innovative solutions across various industries. Analysts currently predict an impressive annual revenue growth of 20.4% for Nvidia, with earnings projected to grow at an average of 20.6% per year over the next three years.

Exceptional Historical Performance and Future Potential of Nvidia Stock

Nvidia Stock‘s track record speaks volumes about its growth potential. Over the past five years, the company has delivered an exceptional total shareholder return of 1448.41%, encompassing both share price appreciation and dividends. This remarkable performance significantly outstrips the broader US market’s 6.1% return over the past year (link to a relevant market performance report – hypothetical), highlighting Nvidia’s ability to consistently outperform its peers, particularly within the dynamic semiconductor industry.

The recent launch of the RTX 5060 series is likely to further strengthen Nvidia Stock‘s revenue and earnings forecasts by solidifying its position in the lucrative gaming market. While analyst estimates for Nvidia’s earnings by April 2028 vary, the consensus points towards a substantial figure, indicating strong future financial health.

Considering the current share price, analysts’ consensus suggests a potential upside of 51.5%, aligning Nvidia Stock closer to its price target of US$169.47. This projection hinges on the company’s continued strong performance and its ability to drive innovation in the rapidly evolving AI and gaming sectors. You might also find our previous analysis on the growth of the AI industry insightful (internal link to a relevant TechNTrendy article).

In Conclusion: A Promising Outlook for Nvidia Stock with Lingering Uncertainties

While the potential for policy reversals introduces an element of risk, the fundamental strength of Nvidia Stock‘s position in the AI and gaming markets, coupled with positive analyst sentiment and recent strategic initiatives, paints a promising picture for the company’s future. For tech enthusiasts and investors alike, keeping a close eye on Nvidia’s developments will be crucial in navigating the exciting opportunities and potential challenges that lie ahead.

Reference: This analysis incorporates information and insights from the article “Nvidia Stock: Wall Street Is Bullish or Bearish on NVDA? See the Target” by Vinod Dsouza, published on April 15, 2025.

Disclaimer: This analysis is based on publicly available information and analyst forecasts and is intended for informational purposes only. It does not constitute financial advice. Investing in the stock market involves risks, and you should conduct your own thorough research before making any investment decisions.

post 9 : #2557D

Tech

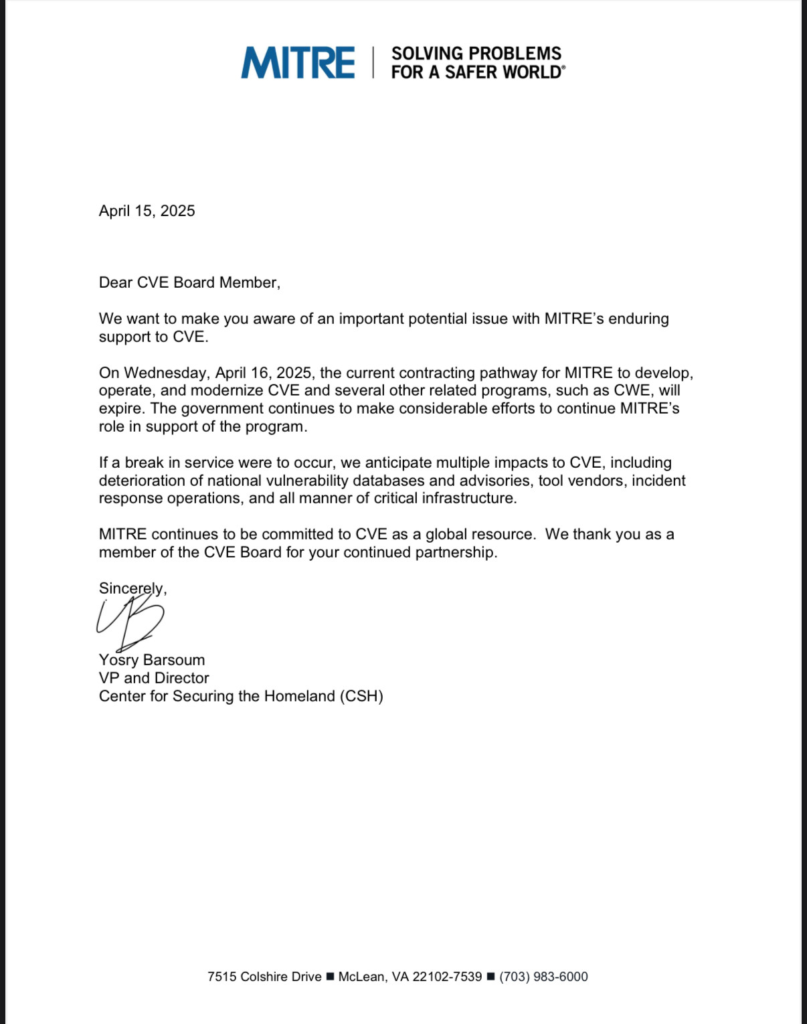

MITRE’s CVE Program Faces Uncertain Future as Funding Set to Expire

MITRE’s Common Vulnerabilities and Exposures (CVE) program, a cornerstone of global cybersecurity for 25 years, is at risk of shutting down as its federal funding expires April 16, 2025. This could disrupt vulnerability tracking for millions of organizations worldwide.

Breaking: Cybersecurity’s Vulnerability Backbone at Risk

By TechNTrendy.com

Last Updated: April 16, 2025

MITRE’s Common Vulnerabilities and Exposures (CVE) program, a cornerstone of global cybersecurity for 25 years, is at risk of shutting down as its federal funding expires April 16, 2025. This could disrupt vulnerability tracking for millions of organizations worldwide.

Why This Matters

✔ Over 250,000 CVEs cataloged since 1999

✔ Critical for patch management, risk assessment, and threat intelligence

✔ CVE Numbering Authorities (CNAs) may soon be unable to assign new IDs

✔ No clear successor program announced

What’s Happening?

- Funding contract expires April 16 (confirmed via internal MITRE letter)

- CWE (Common Weakness Enumeration) program also affected

- Historical CVE database will remain on GitHub, but new assignments may halt

- Centralized MITRE CVE repository could disappear, fragmenting vulnerability data

“This creates massive uncertainty—without CVEs, we lose a universal language for vulnerabilities.”

— Brian Krebs, Cybersecurity Journalist

Potential Impact

| Sector | Risk |

|---|---|

| Enterprises | Slower vulnerability patching, inconsistent tracking |

| Security Vendors | Need alternative databases, possible coverage gaps |

| Researchers | Difficulty disclosing flaws without standard IDs |

| Government | Weakened NVD (National Vulnerability Database) |

Will Vulnerabilities Still Be Tracked?

- Vendors may issue advisories without CVEs

- Alternative databases could emerge (e.g., VulnDB, OSV)

- Tenable, Rapid7, others say they’ll adapt—but fragmentation is likely

What’s Next?

- Last-minute funding extension? (Unlikely per sources)

- NIST may take over, but no official plan yet

- Security firms preparing contingency plans

🔗 Follow Live Updates: MITRE CVE Status Page

Tenable’s Response

As a CVE Numbering Authority (CNA), Tenable assures customers:

✅ Vulnerability scanning will continue (uses multiple sources)

✅ Reserved CVE blocks will help short-term

✅ Research advisories will still publish

“We don’t rely solely on MITRE—but losing CVEs makes defense harder.”

— Tenable Research Team

The Bigger Picture

The CVE program’s potential collapse highlights:

🔴 Over-reliance on a single, underfunded system

🔴 Need for decentralized, resilient alternatives

🔴 Growing gaps in federal cybersecurity support

What Can You Do?

- Monitor vendor advisories directly (not just CVE lists)

- Push for congressional action (Contact legislators)

- Prepare internal tracking systems for non-CVE vulnerabilities

Will the cybersecurity community rally to save CVE? Share your thoughts below.

Blog

NASA Wallops Begins Construction on $103M Causeway Bridge to Support Growing Spaceport Operations

– TechNTrendy.com

Last Updated: April 15, 2025

Key Takeaways:

✔ $103M federal-funded bridge replacement at NASA Wallops Flight Facility

✔ Will support heavier payloads for increased launch cadence (government & commercial)

✔ Construction awarded to Kokosing, completion expected by early 2028

✔ Replaces 65-year-old bridge that’s reached end of service life

✔ Critical infrastructure for Virginia’s expanding space economy

Historic Groundbreaking for Wallops Island’s Lifeline

NASA’s Wallops Flight Facility marked a major milestone on April 14, 2025 with the groundbreaking ceremony for its new causeway bridge—the sole vehicular access point connecting mainland facilities to the launch range on Wallops Island. The event was attended by:

- David Pierce, NASA Wallops Facility Director

- Ray Rubilotta, NASA Goddard Associate Center Director

- Virginia State Senator Bill DeSteph

- Representatives from VA/MD congressional offices

“This bridge enables the science, technology, and national security missions advancing here daily,” said Pierce, noting its role in supporting over 40 annual launches from government and commercial partners like Rocket Lab, Northrop Grumman, and Firefly Aerospace.

Why This $103M Project Matters

1. Replacing Aging Infrastructure

- Current bridge built in 1960 (65 years old)

- Requires frequent repairs due to coastal weather damage

- Weight restrictions limit modern launch equipment transport

2. Designed for Next-Gen Space Operations

| Feature | Old Bridge | New Bridge |

|---|---|---|

| Design | Arched structure | Flat-deck for heavy loads |

| Capacity | 40-ton limit | Unrestricted commercial launch vehicles |

| Lifespan | 50 years (extended) | 75+ year design life |

3. Economic & Strategic Impact

- Supports Virginia Spaceport Authority’s goal of 100+ launches/year by 2030

- Enables transport of larger rockets (e.g., Rocket Lab’s Neutron)

- Strengthens Mid-Atlantic Regional Spaceport’s (MARS) competitiveness

Construction Timeline & Partners

- Awarded to: Kokosing Construction Company (project portfolio)

- Design oversight: Federal Highway Administration

- Completion target: Early 2028

- Innovations: Corrosion-resistant materials, improved stormwater management

Wallops’ Growing Role in U.S. Spaceflight

The bridge is part of a $2B+ infrastructure overhaul at Wallops, including:

- Launch Pad 0C upgrades for Antares 330 and Neutron rockets

- Payload processing facility expansion (completed 2024)

- AI-powered range safety systems

Recent milestones:

🚀 2024: 14 successful launches (up from 6 in 2020)

🛰️ 2025: First Electron launch from new Pad 0D

🔮 2026: Planned human-rated missions via Sierra Space’s Dream Chaser

What Locals & Businesses Should Know

- Traffic impact: Minimal—construction avoids main commuter routes

- Jobs: 200+ temporary construction roles; 50 permanent ops jobs

- Tourism boost: New visitor center opening 2026 with bridge views

The Big Picture: East Coast Space Race

This project positions Wallops to compete with:

- Cape Canaveral, FL (45+ launches/year)

- Vandenberg, CA (polar orbit focus)

- Spaceport Camden, GA (emerging competitor)

“Virginia is becoming the Silicon Valley of space,” noted Sen. DeSteph, referencing $1.4B in private space investments since 2020.

How to Follow Progress

📅 Webcam updates: Wallops Construction Cam

📰 News alerts: @NASA_Wallops on Twitter

Thoughts? Will this bridge transform East Coast space access? Comment below!

Business

Bill Gates-Backed Arnergy Secures $18M to Expand Solar Access in Nigeria Amid Energy Crisis

TechNTrendy.com

Meta Description:

Arnergy, a Nigerian solar startup backed by Bill Gates, raises $18M to meet surging demand as fuel prices soar. Discover how its lease-to-own model is transforming energy access.

Key Takeaways:

✔ $18M Series B funding led by Bill Gates’ Breakthrough Energy Ventures

✔ Solar demand surges after Nigeria’s fuel subsidy removal (500% price hike)

✔ Lease-to-own model now 75% of sales, making solar more affordable

✔ Plans to expand into Francophone Africa

✔ Naira revenues on track to quadruple in 2024

Nigeria’s Solar Boom: Why Arnergy is Winning

Nigeria’s power crisis has reached a tipping point. With grid outages worsening and fuel prices skyrocketing 500% after subsidy cuts, solar energy is no longer a luxury—it’s a necessity.

Enter Arnergy, a Lagos-based cleantech startup backed by Bill Gates, which just secured an $18M Series B extension (TechCrunch report) to scale its solar solutions.

What’s Driving Demand?

-

Fuel subsidy removal (May 2023): Petrol prices jumped from ₦185 to ₦700+ per liter.

-

Grid instability: Nigeria’s national grid collapses 4–6 times yearly (BusinessDay).

-

Rising tariffs: Electricity costs tripled for stable-power users in April 2024.

“Solar is now a cost-saving tool, not just backup power,” says CEO Femi Adeyemo.

Arnergy’s Game-Changing Lease-to-Own Model

Z Lite: Solar as a Subscription

Arnergy’s lease-to-own product (5–10 year terms) now dominates sales:

| Year | Outright Purchases | Lease-to-Own |

|---|---|---|

| 2023 | 60–70% of revenue | 30–40% |

| 2024 | 25% | 75% |

Why It Works:

-

**₦96K (~125) for generators

-

30–50% savings over 5 years

-

Tripled lease customers since 2023

Expansion Plans: Beyond Nigeria

With dollar revenues flat due to Naira devaluation, Arnergy is pivoting to:

-

Dollar-denominated B2B2C partnerships

-

Francophone Africa expansion (details undisclosed)

-

4–5x growth in lease customers by 2025

The Bigger Picture: Solar’s Rise in Africa

Arnergy isn’t alone. Africa’s solar market is booming:

-

M-KOPA (Kenya): $250M raised in 2023

-

Daystar Power (West Africa): Expanding to Côte d’Ivoire

Government policies like Nigeria’s Energy Transition Plan (net-zero by 2060) could accelerate adoption further.

Challenges Ahead

-

Currency volatility: Naira lost 70% value in 2023 (Reuters).

-

Supply chain risks: Solar panel imports face delays.

-

Competition: Diesel generators still dominate SMEs.

Final Thoughts: A Solar-Powered Future?

Arnergy’s success shows Nigeria’s energy crisis is creating opportunities. As fuel costs bite, solar isn’t just cleaner—it’s cheaper.

Will lease-to-own models become Africa’s energy standard? Share your thoughts below!

-

Tech5 months ago

Tech5 months agoiPhone 17 Air: The Thinnest iPhone Ever? Latest Leaks, Specs & Design Details

-

Ai5 months ago

Ai5 months agoGlobal Backlash: Over 50,000 Creatives Condemn Unlicensed AI Training in Landmark Petition

-

Blog5 months ago

Blog5 months agoMagnitude 5.2 Earthquake Shakes Southern California; Aftershocks Rattle San Diego Region

-

Blog5 months ago

Blog5 months agoNASA Wallops Begins Construction on $103M Causeway Bridge to Support Growing Spaceport Operations

-

Tech5 months ago

Tech5 months agoMITRE’s CVE Program Faces Uncertain Future as Funding Set to Expire

-

Tech5 months ago

Tech5 months agoOptical Computing: The Light-Powered Future of AI and Energy-Efficient Processing

-

Tech5 months ago

Tech5 months agoTrilobio: Revolutionizing Lab Automation with Modular, Affordable Robotics

-

Business5 months ago

Business5 months agoBill Gates-Backed Arnergy Secures $18M to Expand Solar Access in Nigeria Amid Energy Crisis